Our expert solution involves sealing up your crawl space with a robust vapor barrier, acting as a shield against water and moisture.

The result is optimal humidity levels for your home or business—a game-changer for comfort and cost savings. Experience a more comfortable living or working environment as your heating and cooling costs decrease, leaving those persistent moisture problems firmly in the past.

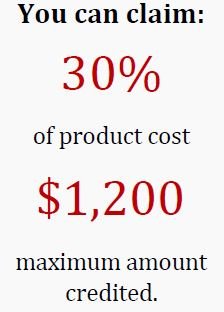

In addition to limits on the amount of credit you can claim for any equipment installation or home improvement, there are annual aggregate limits. The overall total limit for an efficiency tax credit in one year is $3,200. This breaks down to a total limit of $1,200 for any combination of home envelope improvements (windows/doors/skylights, insulation, electrical) plus furnaces, boilers and central air conditioners

What does Colorado’s Weatherization Assistance Program do?

Unfortunately, wheatherization cannot help with cooling

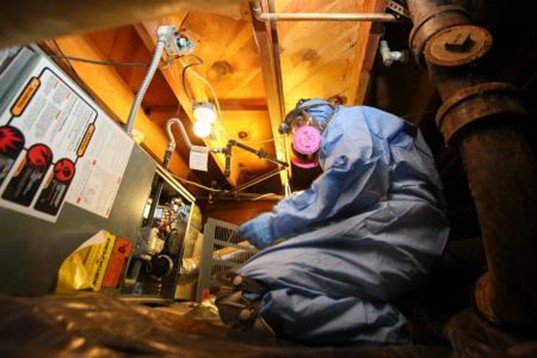

• Insulation in attic, floors, and walls

• Furnace repair or replacement

Apply to the Weatherization Assistance Program

Tap this link to apply: https://socgov02.my.site.com/ceoweatherization/s/

We are a company dedicated to improve the life of people while taking care of the environment.

Copyright © Alex Home Pro 2023